What makes the Miles Franklin Blog so special is the community it has built, of people “fighting the machine” to save their financial lives – and those of loved ones. Readers constantly write of eternal frustration in trying to convince “family, friends, and colleagues” of the reality of a dying monetary system – which must end in economic calamity, currency collapse and the return of Precious Metals – i.e., the “once and future” monetary kings. Trust us, we can empathize. However, given our experience with the blog, we have a unique perspective knowing thousands of readers think similarly – many of whom, actively spread our gospel. And thus, we believe the cumulative efforts of said community is making a significant impact.

In my view, what differentiates our blog – aside from it being published daily, for free – is that David Schectman, Bill Holter and I strive to describe the world from multiple angles. David, with decades of experience in a hard business world, gives a macro perspective resembling Richard Russell, Jim Sinclair and other financial luminaries, in my view. Bill Holter’s points are as hard-driving as they are logical, while mine are influenced by two decades of experience as a classically-trained fundamental analyst. Moreover, we all share a staunch belief in – and detailed knowledge of – the government price suppression scheme that has kept Precious Metals prices well below their equilibrium levels for years; in the process, destroying both the mining industry and global monetary system. Together, we seek to share our knowledge of all these topics; cumulatively, serving roles as analyst, commentator and whistleblower. And for those less experienced in the workings of the opaque, manipulated, and propagandized PM markets, we strive to educate of TPTB’s evil machinations, with the ultimate goal of empowering readers to make correct financial choices.

This week, the latter aim is front and center, as – per what we discussed yesterday and countless times in the past – TPTB are executing their relentless stratagem of attacking gold and silver at pre-ordained “key attack times”; particularly when the Fed Chairman speaks. Such a stratagem has been ongoing for more than a decade, but particularly since “dollar-priced gold” hit its all-time high in September 2011. These two-and-a-half years of “manipulation infamy,” in our view, are unparalleled in financial market history. However, due to the limited – and rapidly contracting – supply of actual, PHYSICAL metal, such lunacy will only serve to create an end game – i.e., a skyward price explosion – equally unparalleled in financial history.

We have discussed such FOMC-related attacks for years; and kudos to “Meridian Macro” for putting together the following chart, depicting how gold has cumulatively lost $331/oz. in the weeks of the previous seven FOMC meetings – compared to essentially no change in the surrounding weeks. Such “lopsided” performance validates our earlier research into how gold performs on NFP payroll days; cumulatively, unchanged in 2013 despite six of 11 reports missing expectations – as starkly compared to the “Dow Jones Propaganda Average,” which averaged an 80 point gain on such days; again, despite six of 11 such reports missing expectations. This is your PPT and gold Cartel at their best – i.e., doing everything possible to frame the economy as “recovering” and the Fed “omniscient” – despite reams of evidence to the contrary.

This week, TPTB’s actions were particularly blatant; as not only was the FOMC meeting, but it was “Whirlybird Janet’s” first as Fed Chairman; hence, the need to portray her as “credible.” To wit, if she announced a “pause” of the supposed tapering strategy, she would be known as a fraud from day one – yielding widespread recognition that she is, in fact, more dovish than even “Helicopter Ben.” Don’t worry, in due time she will make John Law appear hawkish; but for now, the Cartel was determined to make her out to be Paul Volcker. Not that she said or did anything particularly hawkish; but when TPTB’s carefully orchestrated “market reaction” involved falling stock, bond and gold prices, they could be sure the clueless MSM would portray it as such. Throw in the fact that the Ukrainian situation is in fact escalating – and that PM markets have gained significant momentum, whilst global equity markets languished – and it couldn’t be more obvious that the Cartel would be on the offensive.

As discussed yesterday, the current movement to “put PMs in their place” – following two months of capping each and every rise – goes back to late last week, when Thursday and Friday’s PM rallies were stopped at “key attack times” – particularly the 12:00 PM EST “cap of last resort” – to prevent major breakouts. And then, starting Sunday night when gold hit $1,397/oz., an all-out blitzkrieg commenced, encompassing every second of every day. By the time the FOMC statement was published, gold was already down to $1,340/oz., and silver $20.70. Conversely, the prior week’s Dow declines were more than erased by blatant PPT goosing Monday and Tuesday; and thus, when the orchestrated post-FOMC “market reaction” was negative, stocks were just giving back “house money.” PMs, of course, were trashed further, as well as at all subsequent “key attack times” – like 2:15 AM EST, 7:00 AM EST and the 8:20 AM EST COMEX open. Globally, equities and currencies were hit hard – whilst Treasury yields surged, under the very same conditions that created market chaos this winter. But don’t worry, the Dow’s losses were capped at a measly 0.7%, of which half has already been recouped by this morning’s 10:00 AM EST surge – i.e., when the Fed orchestrates its daily “open market operations,” injecting new, freshly printed money into the markets.

In fact, it cannot be emphasized just how dangerous the waters the Fed are treading in have become. By announcing another $10 billion taper – if you believe such lies in the first place – they threaten to accelerate the recent, catastrophic emerging market currency crisis. Only this time around, global economic activity is starting from a lower level, with numerous political crises already ongoing – as in the Ukraine, Thailand, Venezuela and Turkey, among others. To understand just how weak the global economy has become, simply look at Caterpillar’s sales report this morning – depicting a 15th straight monthly decline; plus, Wal-Mart announcing a “Black Friday-like” spring sale, to try and revive plunging sales; and yet another Chinese “shadow banking” default, as copper prices plummet anew, dragging the newly “flexible” Yuan to another multi-year low – wreaking havoc on the global manufacturing landscape and $500 billion of derivatives betting on a rising Yuan.

Regarding Wal-Mart, we cannot emphasize what a business decision this is; in essence, “giving away” product to increase store traffic in an exceptionally weak retail environment. Heck, this rings of what the big “low margin, high volume” player in the PM bullion industry – Tulving – did to both itself (bankruptcy) and many of our competitors (the verge of such) in implementing a similar, equally counterproductive strategy. As David Schectman so eloquently put in discussing Miles Franklin’s 25 years of operation, a business simply cannot survive without profits; and while Wal-Mart isn’t going anywhere, in such a horrific retail environment, such an aggressive strategy will not only dramatically reduce its margins, but destroy countless competitors.

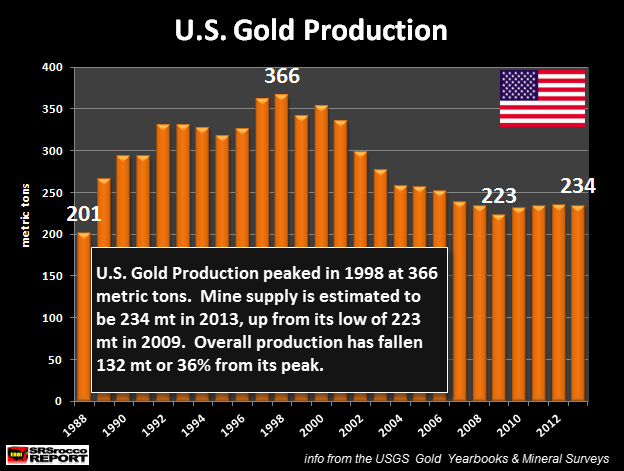

To that end, this is exactly what the Cartel has inadvertently done in pushing paper gold and silver prices below the PHYSICAL cost of production. Since the PM bull market commenced at the turn of the century, prices have gone up more than fivefold – and at their peak, eightfold for gold and tenfold for silver. However, rising mining costs – in large part, due to the Fed-induced inflation PMs are used to protect against – have been unable to keep pace. And thus, with global demand shattering all previous records in 2013, U.S. gold and silver production are down sharply. Globally, gold production is roughly unchanged over this period but only because China, in recent years, is purposely ramping up production at a loss, to secure as much PHYSICAL metal as possible, before the inevitable end game of fiat currency destruction commences.

Back to the Fed, their policy statement could not have been more confusing – or ultimately, dovish. Amidst a veritable ocean of “Fedspeak,” they essentially reiterated their commitment to ZIRP, or Zero Interest Rate Policy, for at least six months after QE is officially ended – which in the “best case” scenario, would keep the Fed funds rate at or below 1% at the end of 2015. In fact, Janet Yellen actually said the Fed “overdid the optimism” in its January communique; while simultaneously, making the ridiculous statement that the Labor Force Participation Rate was starting to improve. Yes, if rising from a 35-year low of 62.5% to 62.7% – compared to 64.0% last summer – is considered progress, than I guess it did. However, what happened to the 1.3 million people whose long-term unemployment benefits expired in December, whom “conveniently” haven’t been subtracted from the Labor Force yet? Not to mention, the portion of the 3.6 million others whose benefits are scheduled to terminate throughout 2014?

And what of the so-called 6.5% unemployment rate “threshold” – created last year as a “guidepost” as to when to end ZIRP? Well, to no one’s surprise, they got rid of it entirely yesterday – contradicting exactly the point Yellen made above. In other words, since employment is decidedly NOT improving, they’ll instead maintain ZIRP for at least another 18 months, even though their updated guidance assumes the “unemployment rate” will fall well below 6.5%. Heck, if the BLS actually is consistent with its own methodology, said “unemployment rate” could fall below 4% by the end of 2015, amidst the worst labor environment since the Great Depression!

Anyhow, it’s now Thursday morning, and it was just reported that the Philly Fed’s employment index plunged to a nine-month low; whilst new homes sales fell to a 19-month low; ominously, led by an 18% decline in the low end of the market, where the highest proportion of Fed-fostered (and ultimately, financed) Wall Street speculation occurred. Care of yesterday’s reckless “taper” announcement – in my view, its last – interest rates have surged higher, dramatically increasing the likelihood that an already moribund global economy will ratchet down further. To that end, copper is hitting a new low, whilst most emerging market currencies are plunging anew. In other words, in the Fed’s misguided attempt to make Yellen look “credible,” they have only made matters worse. Sure, they succeeded in taking PM prices down sharply, amidst four days of unadulterated naked shorting terror; but yet again, physical demand met them head on – particularly silver, where yet again, the U.S. Mint reached its weekly quota just three days into the week. At current, catastrophically low prices, the PM mining industry is literally hemorrhaging money; not to mention, dramatically reducing production and capital expenditure plans…

…and writing off reserves at an alarming pace. In other words, all TPTB accomplished this week was pulling the inevitable, Cartel-killing supply shortage that much closer; which is exactly why one should simply hold physical metal, free and clear and wait.

Moreover, this week’s contrived Fed fantasy of “recovery” – which as noted above, wasn’t much of a fantasy irrespective – should quickly backfire; as not only are emerging markets currencies again plunging – and with them global equity markets – but the renewed rise in Treasury yields will likely accelerate the end of the “tapering” folly. As discussed in “3.0% – Nuff’ Said,” the Fed cannot allow the benchmark 10-year Treasury yield to rise above 3.0%; as such an event will not only destroy the global economy, but its own, heavily leveraged balance sheet. Thus, if the current 2.78% level blows up toward 3.00% in the coming weeks, you can bet the BLS will work its “accounting magic” on the upcoming March NFP report; i.e., producing a rotten, smelly egg of a report to try and calm the bond vigilantes – and thus, push the Fed another step closer to ending the “tapering” charade permanently. In other words, a vicious loop – which frankly, only damages their credibility further, whilst having ZERO effect on those holding long-term savings in the form of PHYSICAL gold and silver. And oh yeah, the technical “golden crosses” the Cartel so desperately seeks to prevent are still going to happen, despite this week’s machinations – in gold’s case, as early as next week.

Hopefully, this article helps you to better understand the “anatomy of an FOMC meeting orchestration.” It happens every time now, as with the global monetary system so close to imploding – and thus, ending the dollar’s “reign of terror” as the world’s reserve currency – TPTB are doing everything imaginable, legal and illegal, to kick the can a few more inches. Those wise to what’s occurring – whom understand the “realization of reality” is spreading virally across the planet – will act to PROTECT themselves while they still can, with the only asset class that has proven its ability to do so throughout history.

To that end, we hope that if you do consider such action, you’ll give Miles Franklin a call. The reason we have been around for 25 years – and ain’t going anywhere – is our reputation of honesty, competitiveness and top-notch customer service. We can be reached at 800-822-8080 and if you’d like to ask me anything, I am always available at ahoffman@milesfranklin.com!Similar Posts: